In the dynamic world of technology and financial services, Apple, a pioneer in digital wallet technology, is about to implement a significant change in its strategy. This change will not only transform the way consumers in Europe make payments, but will also reshape the competitive landscape in the mobile payments space.

Apple is known for its closed systems that guarantee security and a seamless user experience. But pressure from regulatory requirements in the European Union is now forcing the company to make its technology more open. upcoming Approval by European regulators of Apple's plan to open access to the NFC chip to banks and payment providers marks a significant turning point in the company's policy.

iPhone: Opening the NFC chip

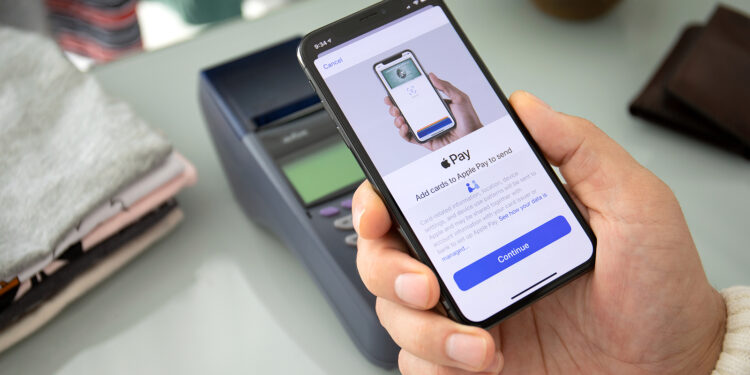

In January quit Apple announced plans to open up NFC payment technology to third-party developers in Europe. This decision follows accusations by the European Commission against Apple of restricting competition by limiting access to the NFC chip. By opening up, Apple will not only counteract potential fines, but also offer European users more freedom to choose their preferred payment methods.

The role of iOS 17.4 changes

With the update to iOS 17.4, Apple has made significant technical changes. Third-party developers and banks now have direct access to the NFC chip, allowing them to offer their own tap-to-pay solutions that work independently of Apple Pay. This feature is offered specifically in the European Economic Area, where users will have the freedom to use alternative mobile wallets directly from their iPhone in the future.

Impact on the market and users

This opening of NFC access could mean a shift in the balance of power in mobile payments. Banks and other payment service providers can offer their customers alternatives to Apple Pay, which increases diversity and competitiveness in the market. For users, this means more choice and possibly better conditions through competing offers.

Apple's strategy change: Opening up the NFC chip to European consumers

Apple is on the cusp of a new era of openness that has the potential to transform the entire mobile payments ecosystem. This development represents a significant step forward for consumer freedom and market pluralism. While final approval from the European Commission is still pending, the direction Apple is taking is a clear sign of the increasing importance of regulation and consumer interests in the technology industry. The coming months will be crucial to see how these changes will impact consumer behavior and the strategies of financial players worldwide. (Photo by DenPhoto / Bigstockphoto)